Warranty and Claims Fraud Detection

The spread of COVID-19 is also damaging corporate balance sheets, as “non-essential” workers remain home, customer orders are delayed or canceled and incoming payments are delayed. AACG can help companies survive the sudden change in the economy and the workforce by managing and forecasting cash flows, prioritizing debt and payment obligations, assessing project and asset values for potential contractions or prospective expansion into new areas. AACG can help your company achieve the best footing possible in these unstable times and prepare for expansion during the recovery.

- Cash flow modeling to understand cash needs

- The current economic environment can present a challenge for managing cash needs. Cash flow modeling either monthly, quarterly, or even annually will identify shortfalls and can also identify opportunities to cover potential shortfalls.

- Forecasted financial statement modeling for debt covenants

- Forecasting financial statements, monthly, quarterly or annually to understand the impact of the current economic environment on debt covenant breaches and other financial statement-related benchmarks.

- Real option modeling to consider abandoning projects

- Using real option theory to assess opportunities to expand, change, or curtail projects based on changing economic and market conditions. Real options can be used to estimate the opportunity cost of continuing or abandoning a project, which may be more relevant in the current economic environment.

- Buy/Sell Agreement valuations to consider transaction options

- Buy/sell agreements often include put options and other transaction options for shareholders. Valuations performed under the current economic environment can help inform the economics of exercising options under a buy/sell agreement.

- Waterfall analysis for security valuation

- Typically relevant for private companies with complex capital structures, waterfall analysis is performed to understand how the current economic environment has impacted the various classes of securities in the capital structure. Waterfall analysis can also be used to understand payouts under various exit/sale/liquidation scenarios.

- Asset impairment analysis

- Performing impairment tests pursuant to financial reporting guidelines. Subject assets can include long-lived assets, intangible assets, and any other asset subject to testing.

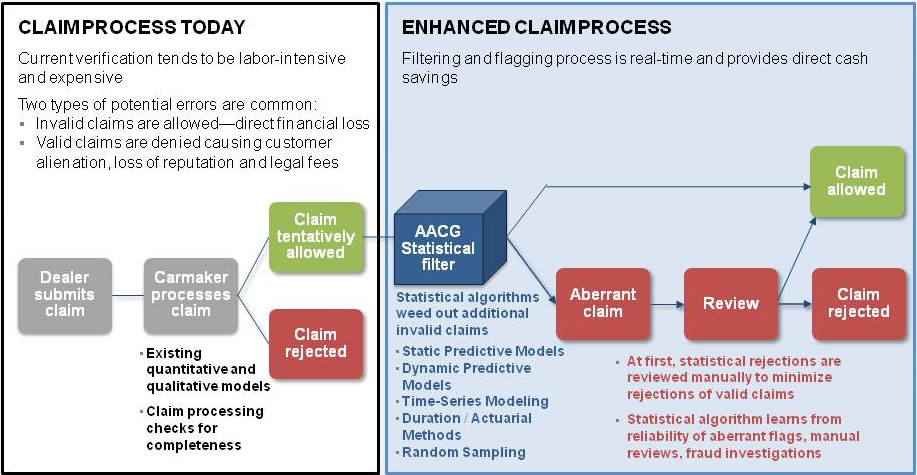

Manufacturers have been taking a scientific approach to quality. Businesses have been improving warranty coverage to tout their new quality levels and seek differentiation from the competition. Today’s businesses need advanced tools to manage warranty review, payments, and administration. However, current warranty systems face two common problems:

- The systems allow invalid claims, which leads to direct financial loss for the manufacturer.

- The systems deny valid claims, which leads to customer alienation, loss of reputation, and legal fees.

Our Solution

AACG’s economists and statisticians help manufacturers enhance the existing warranty management process through the development and deployment of a statistical monitoring system. We use our extensive, proven capabilities to build customized, advanced algorithms to filter and flag invalid claims and provide direct, measurable savings to the bottom line — all in 11 weeks. The monitoring system is designed to identify and reverse invalid claims that would have normally been authorized. The AACG system offers three key advantages to the OEM:

- Reduces invalid claims to make a measurable, direct impact on an OEM’s profitability

- Provides significant benefit to the OEM with minimal investment and minimal interruption to the business

- Produces a long-term, sustainable analytical tool that improves over time

To learn more, contact our warranty team using the links to the right, or email us at info@AACG.com.